Bankruptcy Solution

Bankruptcy is a strategic life-saver and a wise financial strategy.

We are here to help you get the right bankruptcy advice from the best bankruptcy attorney.

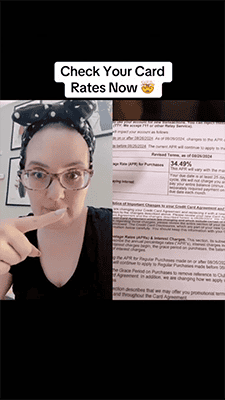

Most people fear bankruptcy. But here’s what they don’t know …

Bankruptcy comes with a ton of benefits. Here are just three.

Immediate relief from debt

Bankruptcy stops collections, wage garnishments, and lawsuits—immediately. That means no more dodging phone calls or living in fear of your paycheck being taken.

A clear financial reset for building wealth

You get a clean slate to start building wealth. With your debt behind you, your income becomes your own again—so you can start saving, take a vacation, or invest in your future.

A faster path to great credit

Most people think bankruptcy destroys your credit. But the truth is: you can rebuild a strong score in 12 to 24 months—and we’ll show you exactly how.

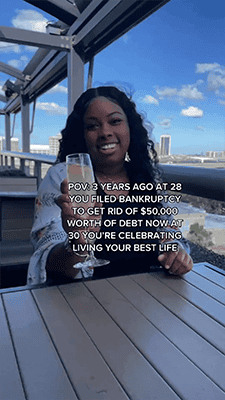

Testimonials:

Hear from our clients

We help you manage your bankruptcy and show you how to use it to rebuild your credit within just 12 to 24 months.

Yes, going through bankruptcy can actually be beneficial for your credit, and we'll demonstrate how.

See the success stories from clients who have successfully navigated this path.

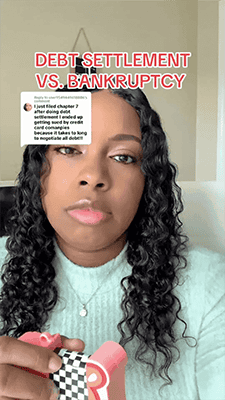

How It Works

Far from being shameful, bankruptcy is a powerful strategy for getting out of the financial situation you find yourself in, using all the legal options available to you.

Set an Appointment

Or, schedule time to talk. We will review your options, and answer any of your questions.

Need More Info?

Join our mailing list, and we will send you more information about the bankruptcy process.

What to Expect

Personalized Service

Our bankruptcy attorney partners will work with you on a personalized plan to eliminate your debt.

Credit Education

Our partners will enroll you in the course “7 Steps to a 720 Credit Score” for FREE as part of your bankruptcy. Most clients have a 720 credit score in 12-24 months after their bankruptcy.

Rebuild Your Credit

After your bankruptcy is complete, we will review your credit report for errors. 38% of the time, we find an error; when we do, we send certified letters on your behalf. We are there for you before, during, and after your bankruptcy.

Our Client's Stories

Not only will we help you with your bankruptcy, but we will show you how to use your bankruptcy to rebuild your credit in just 12 to 24 months. (That’s right: Declaring bankruptcy might improve your credit score – and we will show you how.)

“After my bankruptcy, I felt so much peace. The weight was lifted off my chest. I could take a breather, inhale, and exhale. My mind was so much clearer: I could map out my plan on what I wanted to do to complete my goals.”

“I recently took the 720 credit-building course, and I’ve been able to turn my credit around: I believe my credit was only 415 when I started. I’m now at 695. I’m now able to drive a brand new car. I bought a three-bedroom, two-car garage house. No more pressure or stress!”

Call Today!

Or, book time in our calendar, and we will connect you with an attorney who can empower you to start your debt relief journey.

We help people file for bankruptcy relief under the Bankruptcy Code. You consent to receive text, email, or phone calls by submitting your information. You agree to receive text messages from us by providing your phone number. Message and data rates may apply. Message frequency varies. Also, customers can text “STOP” to opt out anytime.